Sen. Bernie Sanders actually doing something about it -

"Apple Inc. avoided paying billions of dollars in U.S. income taxes. A Senate investigation found the tech giant parked overseas about $102 billion of its $145 billion in cash. A subsidiary in Ireland that earned $22 billion in 2011 paid just $10 million in taxes, according to the report by the Senate Permanent Subcommittee on Investigations.

“It is a total scam,” Sen. Bernie Sanders told Ed Schultz on Tuesday. “It’s not just Apple. Virtually every major multi-national corporation has used these offshore tax havens.” Bernie has introduced legislation that would eliminate the tax breaks and generate $600 billion in revenue over a decade.Listen to Bernie talk about Apple on The Ed Show »

Read more about Bernie's legislation »"

“It is a total scam,” Sen. Bernie Sanders told Ed Schultz on Tuesday. “It’s not just Apple. Virtually every major multi-national corporation has used these offshore tax havens.” Bernie has introduced legislation that would eliminate the tax breaks and generate $600 billion in revenue over a decade.Listen to Bernie talk about Apple on The Ed Show »

Read more about Bernie's legislation »"

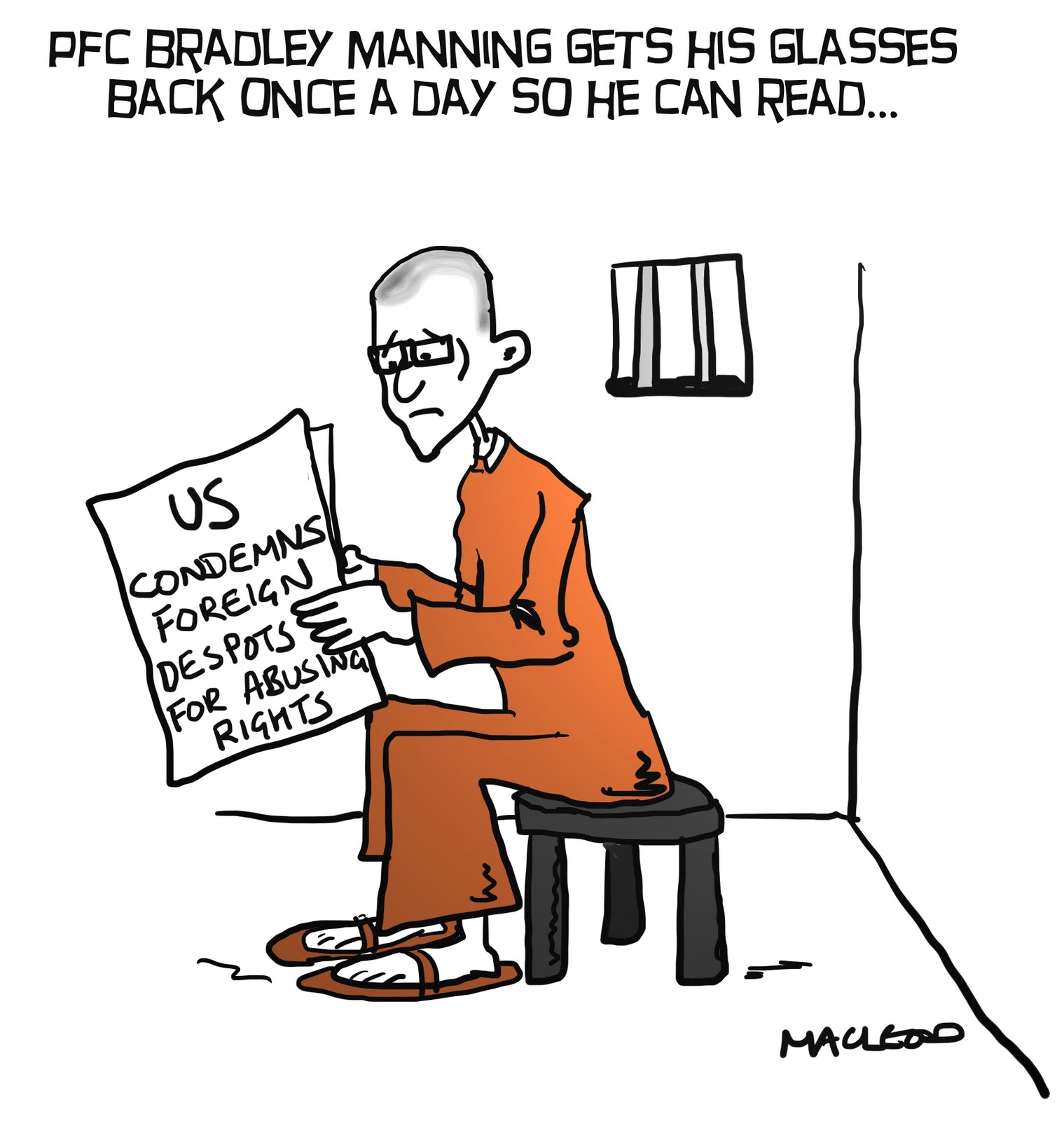

Bradley Manning's "trial" at the hands of the very military whose crimes he's accused of exposing....

A Quote from a famous Israeli:

A Quote from a famous Israeli:

“The test of democracy is freedom of criticism.”~ David Ben-Gurion

........ but for now I'll settle for a taste of this Review in the LA Times of Sunday, April 21st, in which "David Graeber looks at the Occupy movement, from the inside"

The reviewer, Ben Ehrenreich, isn't entirely satisfied with the book, by a well-known Anarchist theorist. The Democracy Project, he says, "provides a rather hurried insider's view of the Occupy movement's beginnings and a far-too-cursory account of its collapse."

But he does give some memorable selections from what David Graeber has to say.

(Sadly, I guess it's necessary here to explain that "Anarchist" and "Anarchism" do not mean Chaos and Violence, as the establishment have told us ad pukeum. Monarchy means "rule by one person", Oligarchy means "rule by a small group" - which is what many of us feel we live under at present - and An-Archy means no government, the idea that free people are quite responsible enough to run their own affairs, without being ordered around by an elite whom they cannot influence or control.)

"Just open a window or turn on the TV — the same old civilization is rotting all around us. Budget cuts, police shootings, endless and ever-broadening wars, the climate in full-scale, almost-end-times spasm, a Congress of hand puppets yelping on about the manufactured crisis of the moment, a president whose answer to every crisis is More of the Same. Analogous situations have, over the last four years, lighted the streets on fire in Britain, France, Spain, Ireland, Latvia, Italy, Greece, Chile, Tunisia, Egypt, Bahrain and Syria, to name a few."

"At the center of Graeber's project is an attempt to rescue the Occupy movement from the irrelevance to which most pundits assigned it. Graeber deftly diagnoses the corporate media-imposed "straitjacket on acceptable political discourse" that guarantees that raising certain questions — about, for instance, the plutocratic and frankly kleptocratic nature of a system in which government bows before a financial services industry whose main "service," he points out, is the creation of bottomless consumer debt — marks you as an extremist lunatic unfit to be heard on the air. `The result,' he writes, `is a mainstream ideology … which almost no one actually holds.'"

You can read the whole review here.

Ehrenreich also credits anthropologist David Graeber: "whose anarchist politics, scholarly virtuosity and long history of activism had already earned him a measure of stardom among left intellectuals, a celebrity that would grow exponentially with the publication of his monumental and often brilliant book "Debt: The First 5,000 Years" in July 2011."